Until recently, it was all going swimmingly for Super Micro Computer (NASDAQ: SMCI). The growth stock joined the prestigious S&P 500 in March, by which point it had surged by a staggering 6,600% in five years.

Then everything started unravelling for the IT infrastructure company. As I write, the share price has lost 78% of its value in just eight months. Talk about a fall from grace!

However, Rolls-Royce stands as a powerful example of what’s achievable through a successful turnaround. The FTSE 100 engine maker was on the brink of bankruptcy during the pandemic, yet it survived and is now thriving. The stock’s soared 1,300% in four years!

Might such an epic rebound be on the cards for Super Micro stock at some point? Here are my thoughts.

Incredible growth

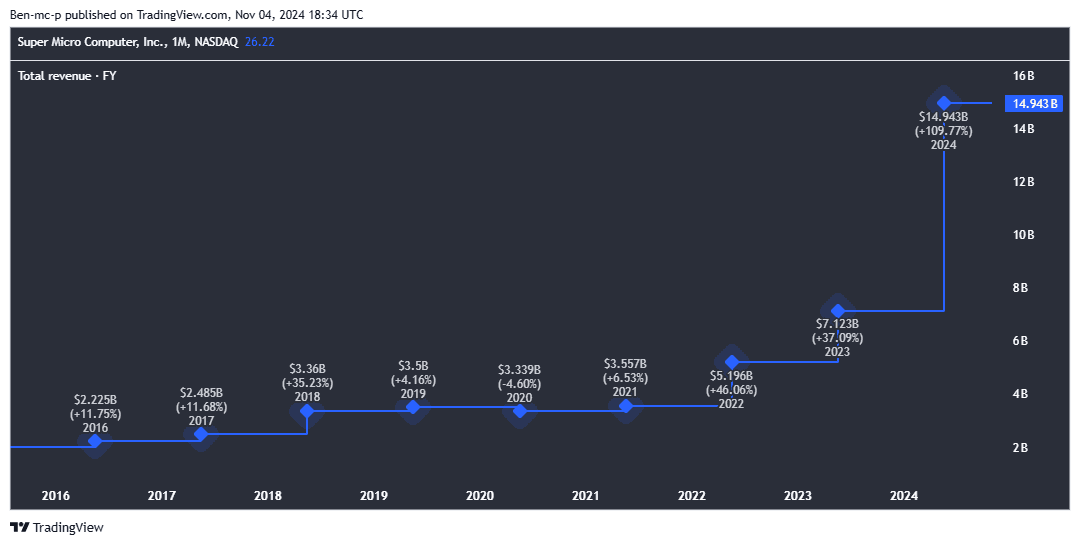

For those unfamiliar, the company makes hardware for data centres and artificial intelligence (AI) applications. Its energy-efficient servers (often packed with Nvidia‘s chips) have seen incredible demand as the generative AI revolution has exploded globally.

We can see this in Super Micro’s revenue, which more than doubled to $14.9bn last year.

Omnishambles

So why have the wheels come off? The reasons are almost too numerous to list. But starting in August, the firm said it wouldn’t be able to file its audited annual report on time. That’s obviously never a good sign.

Then an explosive report from short seller Hindenburg Research was published. In this, it made a number of serious allegations against Super Micro. The main ones were:

- Accounting manipulation

- Rehiring of top executives who were directly involved in past accounting scandals at the firm

- Significant undisclosed business dealings with companies controlled by the CEO’s family members

- Continuing to do business with Russia, violating US sanctions

Last month, it was reported that the US Department of Justice is in the early stages of investigating the company. Oh, and the Nasdaq is also threatening to delist the stock due to the missing annual report.

And as if all that wasn’t enough, Super Micro recently disclosed that Ernst & Young has resigned as its auditor (after just 17 months).

Should I buy Super Micro stock?

Now, it needs to be stated that Super Micro denies all these allegations. Also, Hindenburg Research is a short seller, which means it borrows shares and sells them, hoping to buy them back later at a lower price after a scathing report (pocketing the difference as profit). So it benefits from the stock’s decline.

Of course, it’s always possible for Super Micro to turn things around. A new auditor and management could stabilise things, while revenue and earnings may well continue to climb higher due to growing AI demand.

Moreover, the stock appears dirt cheap, trading at a mere 7 times forecast earnings for this financial year. So I wouldn’t totally rule out a big share price recovery.

However, I want no part of this. Reports say that Nvidia has started to route orders away from Super Micro due to these alleged accounting issues. If so, that could seriously impact future growth.

Moreover, on announcing its resignation, Ernst & Young said it was “unwilling to be associated with the financial statements prepared by management“. Yikes!

There’s far too much uncertainty here for me. Therefore, I’ll invest elsewhere in November.