The last month wasn’t particularly good for the FTSE 250, but it was brilliant for construction company Morgan Sindall Group (LSE: MGNS).

It’s the best-performing stock on the index end over that period, its shares spiking 29.54%. This isn’t a one-off either. The Morgan Sindall share price has more than doubled over the last year, rising 105.11%.

The shares are smashing it today

Over five years, it’s up a blockbuster 197.12%. To put that into perspective, the FTSE 250 climbed just 3.56% during what was a volatile period for stock markets, thanks to Covid and the cost-of-living crisis.

That’s just one reason why I prefer to buy individual shares rather than index trackers. When they fly, they can really fly. Of course the opposite can happen too.

Morgan Sindall’s latest share price explosion followed an update on 22 October stating that full-year profits would be “significantly ahead” of expectations. It pinned this on “exceptional volumes” in its fit-out arm Overbury, which provides office refurbishment and as well as interior design and build services. Its order book jumped 15% to £1.3bn.

The group’s construction and infrastructure units were on target to meet full-year 2024 revenue and margin goals, and its partnership housing arm beat expectations too.

Its mixed-use partnership division remained “subdued” but with total secured orders of £8.9bn on 30 September, markets didn’t care. Especially since this followed record first-half results, published on 8 August, with revenues up 14% to £2.2bn and adjusted profit before tax up 17% to £70.1m.

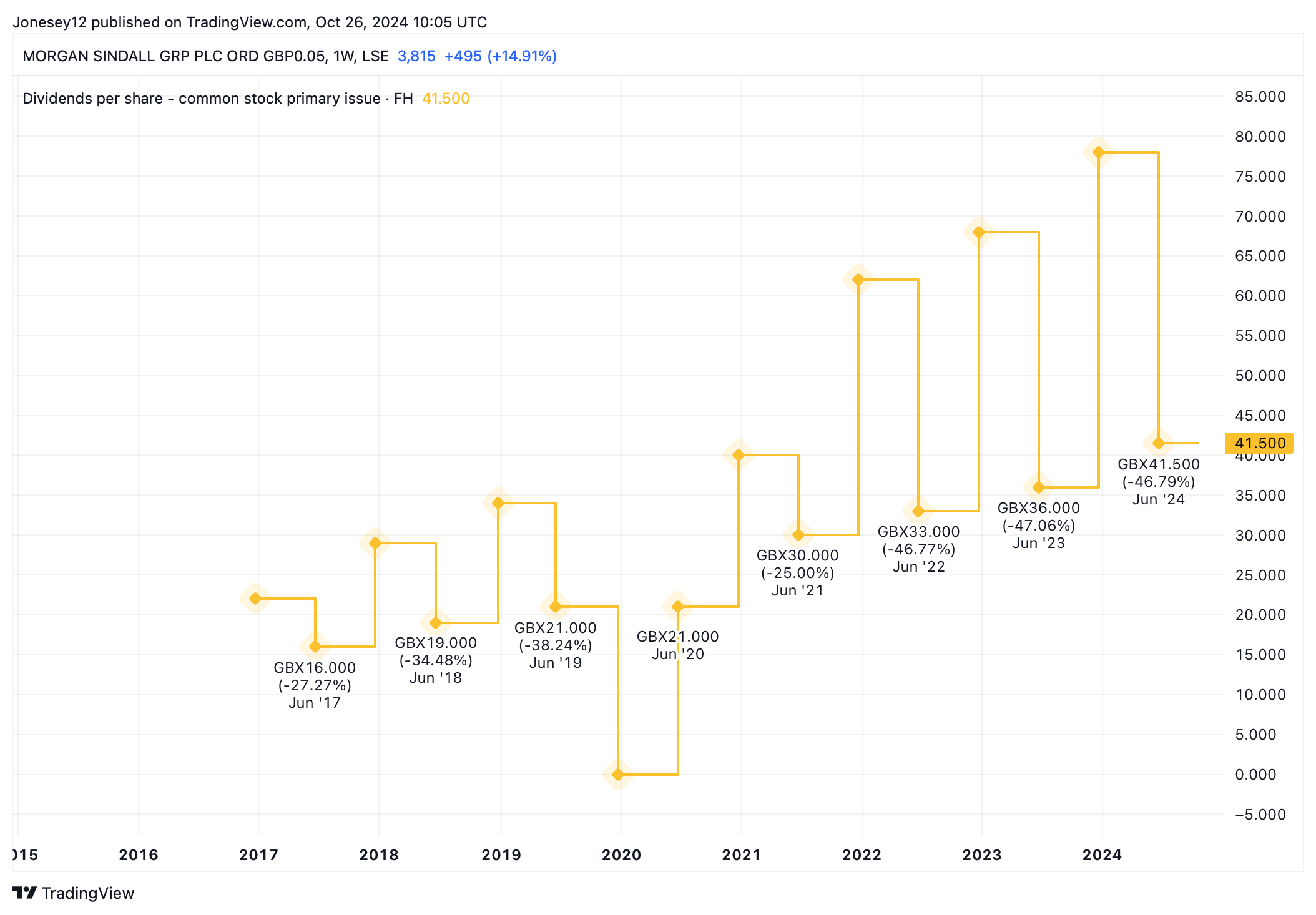

Net cash jumped from £263m to £351m year-on-year, and the board capped all that by hiking the dividend by 15% to 41.5p per share.

It’s a stunning growth stock

Morgan Sindall doesn’t just offer growth in spades, it has consistently increased dividends, too (pandemic year excepted). Its trailing 2.99% yield is impressive, given how fast the share price has grown. Let’s see what the charts say.

Chart by TradingView

I have a confession to make. I’d never heard of Morgan Sindall until this morning. It only came to my attention because of its stellar performance. If I was a better, wiser investor, I’d have spotted its potential years ago, and be feeling smug and rich today. Alas…

As ever with momentum stocks, I’m worried I’m arriving at the party too late. So can Morgan Sindall continue to fly?

It still looks good value with a modest price-to-earnings ratio of 15.5%. The five analysts offering one-year share price forecasts have set a median target of 3,540p per share. That’s actually a 7.18% drop from today. However, I imagine those were produced before the recent bumper results, when the share price was lower. So I suspect they’re behind the curve.

Buying a stock after it’s jumped 30% in a month is asking for trouble. I’m likely to get hit by a bout of profit taking.

Also, investors are looking forward to falling interest rates and Labour’s plans to revive housebuilding and construction. But if rates remain high or Labour undershoots its construction targets, the sector could slip. Investor expectations are sky-high for this stock, and any underperformance will be punished.

I still believe Morgan Sindall’s future looks bright. If the economy does recover, it could look even brighter. I’ll buy when the profit-takers sell.