UK share prices have largely been buoyant in 2024 following years of underperformance. The FTSE 100 and FTSE 250 have both gained around 7% since the start of the year. But the spectre of a stock market crash continues to unnerve investors at as the fourth quarter gets under way.

In fact, research from Saxo Bank has revealed “a notable shift in market sentiment compared to previous quarters, as investor confidence in global equity markets softens.”

How likely is a stock market crash? And what should I do?

Sentiment sinks

Saxo interviewed 712 of its clients. Its report showed that “while many respondents remain optimistic, there is growing concern over inflation, interest rates, and geopolitical risks, all of which continue to shape market expectations for the next three months.”

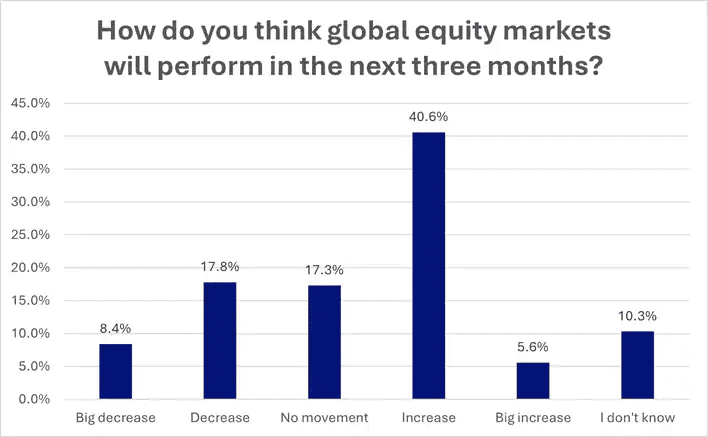

As the chart shows, investors remain positive about the direction of stock markets in quarter four. Some 40.6% of those questioned expect share prices to increase in the period.

However, client optimism is declining at an alarming rate. Saxo said that 42.1% of respondents expected stock markets to rise in Q3, which itself was down sharply from 50.5% during Q2.

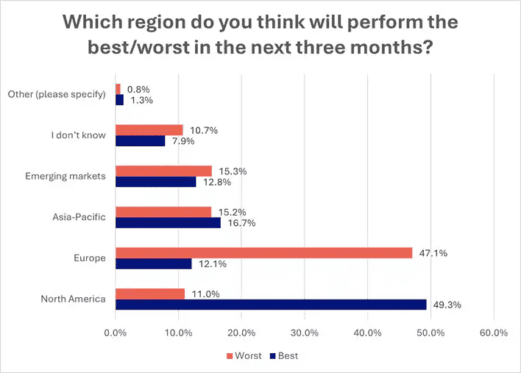

Worryingly for UK investors, the bank’s customers believe European share indexes will perform most poorly this quarter.

An overwhelming 47.1% of those surveyed think Europe will be the biggest underperforming sector. This is up sharply from the 25.9% that made the same prediction in Q3.

Thinking like Buffett

So what happens next? The truth is that nobody knows. Trying to guess the near-term direction of stock markets makes a fool of even the most experienced investor.

This is why I plan to continue buying shares for my portfolio. As a long-term investor like Warren Buffett, the prospect of some temporary turbulence doesn’t put me off.

In fact, if stock markets crash, I’ll be looking to snap up some bargains. While past performance is no guarantee of the future, I’m reassured by the stock market’s consistent ability to rebound from shocks.

Take the FTSE 100, for instance. It’s recovered strongly from numerous crises since its inception in 1984 to post record highs of 8,474.41 points earlier this year. These include the dotcom bubble, the 2008/09 financial crisis, the Brexit referendum, and the Covid-19 pandemic.

One FTSE 100 bargain

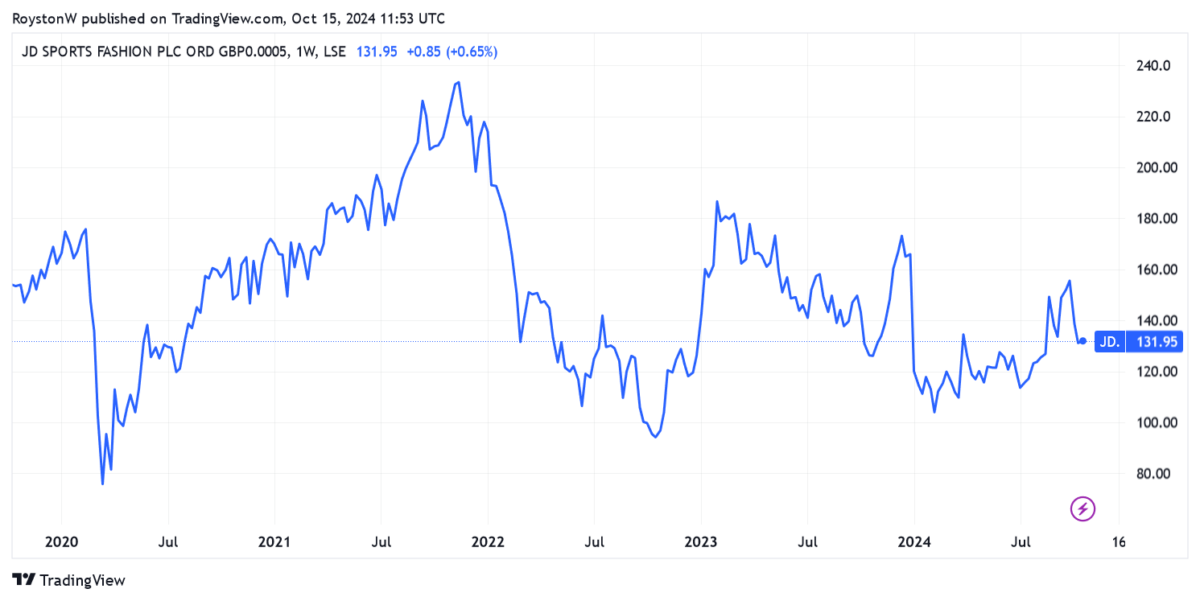

JD Sports Fashion (LSE:JD.) is a beaten-down Footsie share I’m already considering buying for my portfolio. After a shock drop during January, the retailer remains around 20% cheaper than it was at the start of 2024.

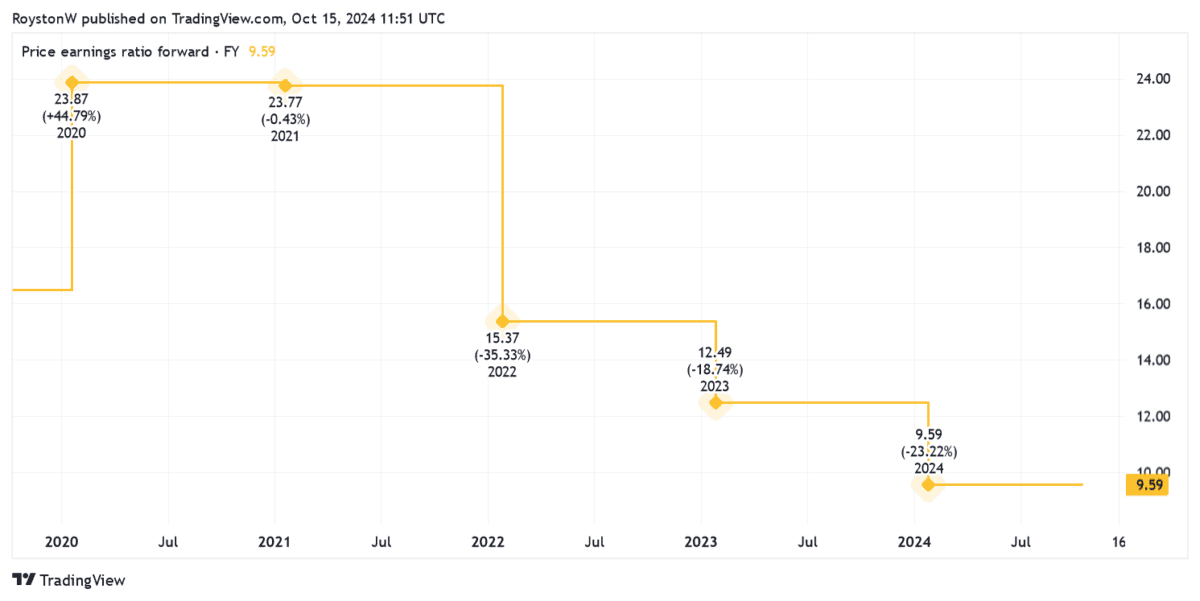

As a result, it trades on a forward price-to-earnings (P/E) ratio of just 9.6 times. As the chart shows, this is significantly below readings of the past five years.

JD’s share price plummeted in January as it warned on profits due to weak sales. This remains a threat going forward, but one I believe is baked into the company’s rock-bottom valuation.

Trading at the sportswear giant is also showing signs of having stabilised. Organic sales rose 6.4% in the six months to July, pushing pre-tax profits to a forecast-beating £405.6m. Profit was a lower £397.8m the year before.

I think JD could deliver strong long-term returns as the sports fashion segment grows in the coming years.