FTSE 100 company Ashtead Group‘s (LSE:AHT) a global leader in rental equipment, operating in the UK, US and Canada. Between March 2020 and November 2021, the share price rose from £14.57 to £64.50 – a 342% leap. This was largely driven by high sales at its US rental business, Sunbelt. It also made 27 acquisitions throughout the year.

But things have been more subdued lately, with the price up only 17% in the past year. Financial performance remains strong however, driven by consistent demand for its rental equipment across various end markets. In 2023, it reported a substantial increase in revenue and profits, demonstrating its resilience and ability to capitalise on favourable market conditions.

Rising demand

Last month, the US Federal Reserve cut interest rates for the first time in over four years. This should take some pressure off businesses and is expected to ignite a construction boom. This is why major broker Berenberg put in a Buy rating on the stock last month. It believes the growing demand for data centres and semiconductor factories could benefit Ashtead’s US business.

Earnings per share (EPS) slumped from $3.81 to $3.55 over the past year, but analysts believe the worst is now over. In the next three years, EPS is expected to rise to $5, or more. The company’s future return on equity (ROE) is forecast to be 22.9% in three years — almost double the industry average.

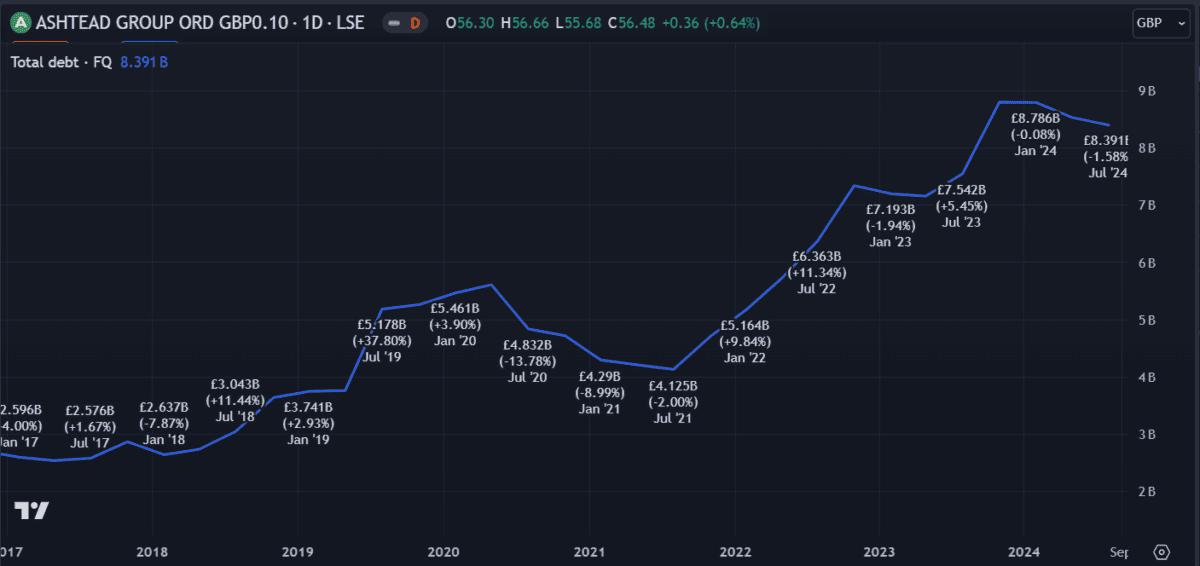

But there’s some concern. With a debt load now exceeding $8bn, Ashtead needs an earnings boost. Although that amount has reduced slightly this year, its debt-to-equity ratio is still above 100%, putting it in a precarious position.

Not for the faint-hearted

Looking at historical price action, it seems the rental equipment industry may be sensitive to economic fluctuations. As such, a significant economic downturn could lead to reduced demand for rental equipment, impacting Ashtead’s revenue and profitability. Keeping that in mind, Ashtead’s very much a growth stock — not the type of slow and stable income stock investors might choose for a passive income portfolio.

It also faces the threat of competition from other rental equipment companies, both domestically and internationally. Market leader or not, a rising competitor could pressure margins and limit pricing power. Since it provides rental equipment on credit, the inability to meet payment obligations could result in financial losses.

A worthwhile consideration

Overall, I think Ashtead Group has the potential to do very well in the coming years. It appears to be a well-managed business with solid financials and an attractive valuation. However, its success is heavily reliant on the US economy which is showing early signs of recovery.

If that holds out, it could drive significant growth for the firm. If not, it could be in for some volatility. I’d consider it a medium-risk option that could handsomely reward brave investors. For now, I’ll keep an eye on the stock and consider buying if it continues to reduce its debt load consistently and sustainably.

This post was originally published on Motley Fool