Over the last five years, the BP (LSE:BP) share price has underperformed all of the other oil majors. Of the six, it’s the only one that’s lower than it was in 2019.

That’s partly due to the company’s recent record of putting its capital in the wrong place at the wrong time. But the firm’s recent change of direction has me looking more closely at the stock.

Pivot

BP’s been active in looking to invest in renewable energy generation. The trouble is, the last few years have arguably been exactly the wrong time to be trying to do this.

High inflation and rising interest rates have made projects expensive. And it’s unclear that a company like BP has any particular competitive advantage when it comes to wind and solar.

Under CEO Murray Auchincloss however, the business has been focusing on what it does best. Earlier this week, the firm announced its intention to scrap plans to cut oil production by 2030.

I think that’s the right move. But there’s a danger that – just as the company tried to move into renewables at exactly the wrong time – something similar might be happening here.

Oil prices

Oil prices are volatile at the moment and I think there are good reasons to expect this to continue. The most important thing, in my view, is the output from Saudi Arabia.

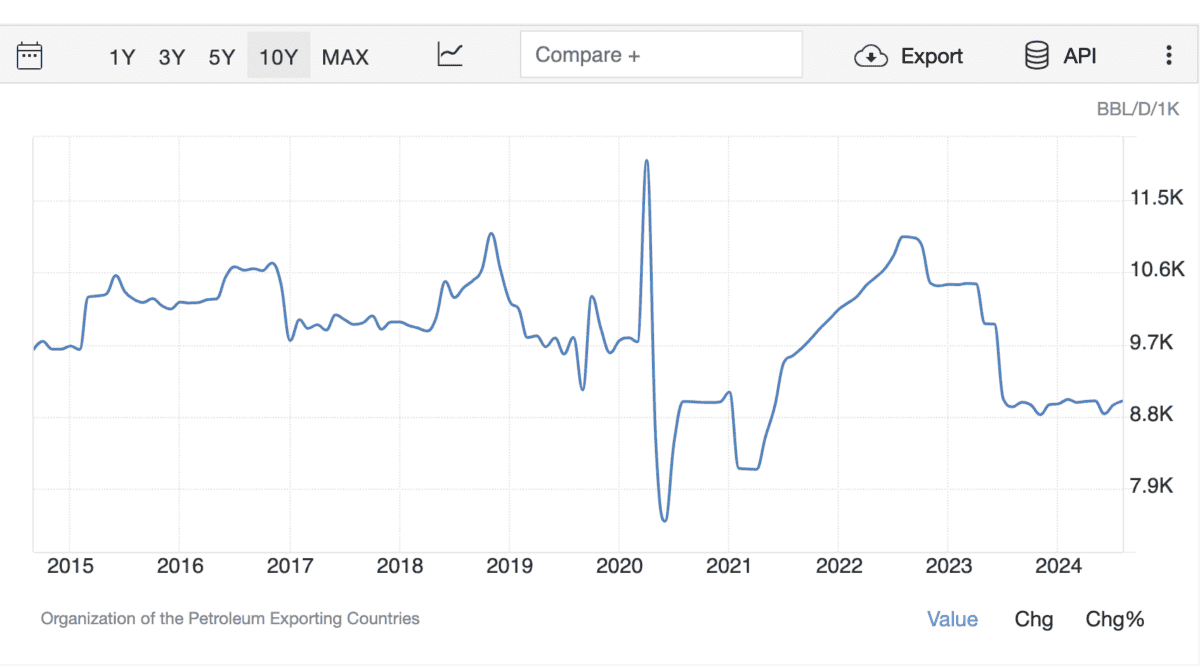

Saudi Arabia Crude Oil Production 2014-24

Source: Trading Economics

Behind the US, the country’s the second-largest producer of oil, but its crude oil output’s currently down at pandemic levels. And that’s having a positive effect on oil prices.

The decline in production’s been voluntary. In 2023, Saudi Arabia announced it was going to continue to limit supply – along with other OPEC+ countries – to support prices.

This, however, could be about to change. And while government stimulus in China might boost demand, I think the overall effect on oil prices could well be negative.

Back to BP

Lower oil prices would be bad for BP, so there’s a real danger the company’s – once again – shifting its focus at just the wrong time. But I think the long-term picture’s more encouraging.

Despite China’s rapid slowdown, global oil demand continues to grow. And until something big happens with generating and storing energy from renewable sources, I don’t see that changing.

On top of this, refining capacity hasn’t grown at the same rate as demand for gasoline, jet fuel and diesel. As a result, I expect margins to improve in this area in the future.

Having got itself back to focusing on its core competencies, I think BP’s now well-positioned to benefit from this. The only question for me is whether now’s the right time to buy the stock.

When to buy?

The BP share price might have fallen but I don’t think its shares are exceptionally cheap just yet. On a price-to-book (P/B) basis, it’s roughly in line with its average over the last decade.

I like the direction the company’s heading in though. And with a lot going on that affects oil prices, I’m on the lookout for a buying opportunity in the near future.

This post was originally published on Motley Fool