I don’t hold any Tesco (LSE: TSCO) shares but looking at how they’ve done lately, I wish I did. So what’s stopped me investing in the FTSE 100 grocer?

There were several reasons. The UK grocery sector’s highly competitive and was being targeted by two aggressive entrants — Aldi and Lidl — determined to build share by driving food prices lower. As the dominant player, Tesco had most to lose.

FTSE 100 star

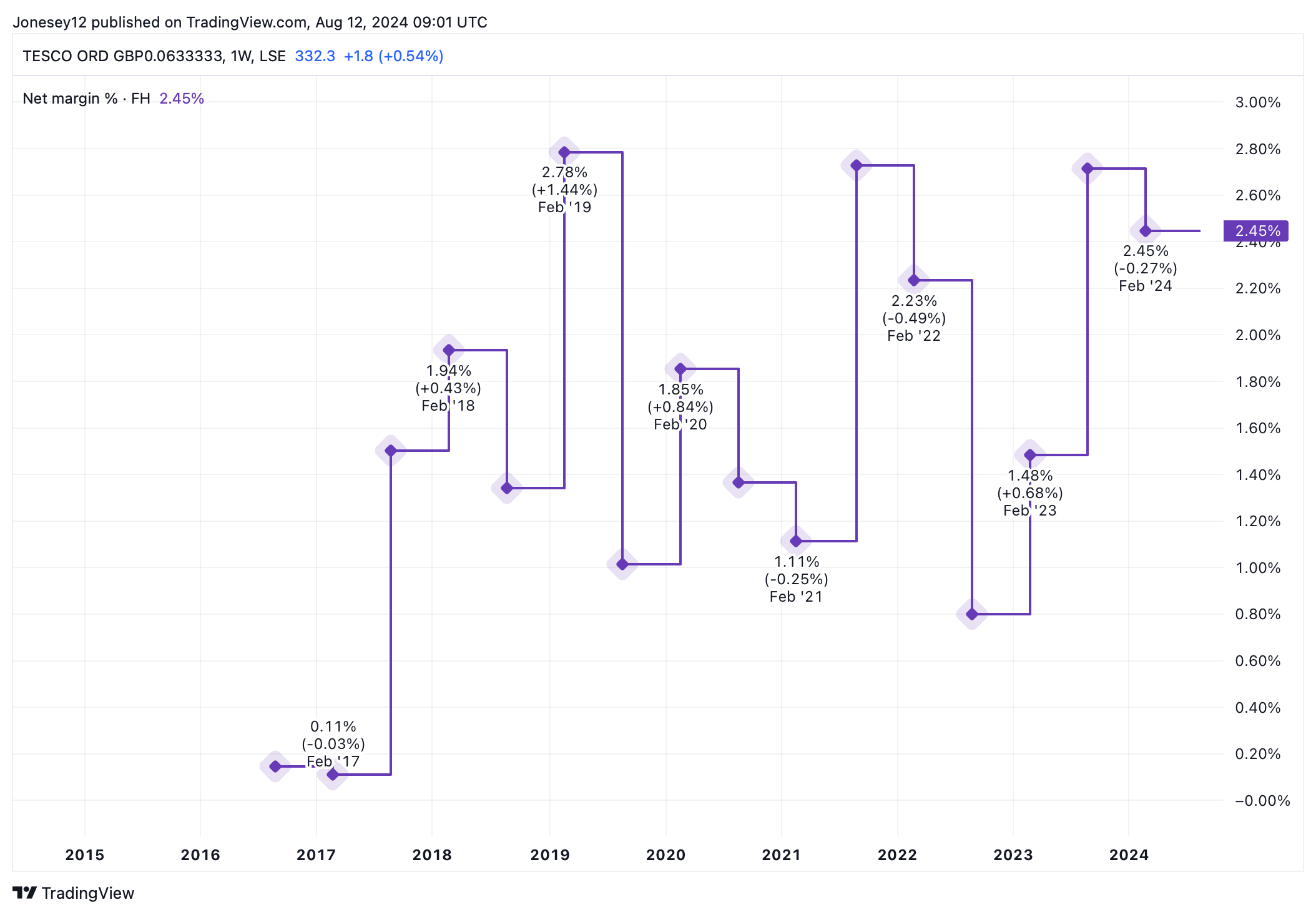

The cost-of-living crisis squeezed shoppers while driving up costs. Tesco has plenty of those costs, as it has to maintain a chain of stores and small army of employees. Margins have been wafer-thin at less than 3% for years. Let’s see what the chart says:

Chart by TradingView

All of those look like sound rational arguments for not buying, but the proof of the pudding is in the eating, and the eating’s been good. The Tesco share price is up 51.47% over five years and 30% over 12 months. It also breezed through last week’s turbulence.

Tesco showed its beef in 2024, with full-year statutory revenues up 4.4% to £68.2bn, and retail adjusted operating profit up 10.9% to £2.76bn. It also paid off £729m of net debt, reducing the pile to £9.76bn.

Its good form has run into the 2025 financial year, with Q1 sales up 4.6% to £11.3bn. Market share’s now growing at the fastest rate in two years, up 52 basis points to 27.6%.

The good news was overshadowed by a row over CEO Ken Murphy’s £10bn pay packet, boosted by a performance-linked bonus of £8.3m. Can he keep delivering the goods?

Dividend growth

Analysts forecast that revenue growth will slow over the next couple of years, rising a modest 2.43% to £69.85bn in 2025, then 2.17% to £71.37bn 2026. I’m a little surprised, as rising real terms wages and forthcoming interest rate cuts should make shoppers feel a bit richer. Tesco’s Clubcard also gives it highly valuable insight into clients’ tastes. A staggering 22m households have one.

Tesco shares don’t look too expensive at 13.94 times trailing earnings. As well as growth, they’ve been a steady source of dividend income. The board held the 2023 dividend at 10.9p per share but hiked it 11% to 12.1p in 2024. It’s forecast to pay 13p in 2025, a rise of 7.44% if it comes through.

Time will tell, but with retail free cash flow doubling to £2.82m in 2024, Murphy can surely afford to be generous. The shares are forecast to yield 3.89% in 2025 and 4.23% in 2026.

Based on the forecast 13p dividend per share, I’d need to buy 7,692 Tesco shares to hit my dividend income target of £1,000 a year. At today’s share price of 331.5p that would cost me £25,499, which is more than my total ISA allowance. Sadly, I can’t stretch to that.

Investing £5,000 would buy me 1,508 shares for a forecast income of £196. It’s not as much as I hoped, but it should rise over time, especially if I add to my stake later. I’ll buy Tesco when I have the cash.

This post was originally published on Motley Fool