It’s not been a great start to the week for the FTSE 100. As I write, it’s down 2.1%. But looking at the performance of the FTSE 100 and FTSE 250 over the last 12 months, it’s safe to say that UK shares are coming back into fashion.

We’ve been through years of uncertainty. Yet slowly but surely, things are now on the up. The FTSE 100 is up 5.9% in the last year. The FTSE 250 has posted an impressive 7.5% gain.

It looks like we’re set for some short-term volatility as fear of a stock market crash heightens. But I’m focused on the bigger picture.

I reckon the UK stock market could keep up its strong performance in the months and years to come. Here are two reasons why.

Reason #1

Despite share prices rising in the last year, I think a number of stocks still look dirt cheap.

One way to judge this is by looking at the average price-to-earnings (P/E) ratio of the FTSE 100. Right now, it sits at around 12 times for trailing earnings and 10 times for forward earnings. Its long-term historical average is between 14 and 15.

It’s not just me who thinks the UK market looks like a pool of opportunities. According to St James’s Place, UK stocks could be trading at as much as a 50% discount to their US peers.

What’s more over 50% of companies within the MSCI UK Index have bought back their shares in the last year. That’s the highest percentage of any market across the world.

Reason #2

Second, we have falling interest rates. We saw the Bank of England cut the base rate to 5% on 1 August. As rates continue to come down, this should provide investor sentiment with a boost, which will hopefully push up share prices.

Falling rates also mean leaving money in the bank becomes less attractive. As a result, investors may feel more inclined to put their money to use elsewhere, such as the stock market.

An example

With that in mind, I’d buy more Barclays (LSE: BARC) shares today if I had the cash. Despite rising 30.7% year to date, I reckon at 202.9p the stock looks dirt cheap on paper.

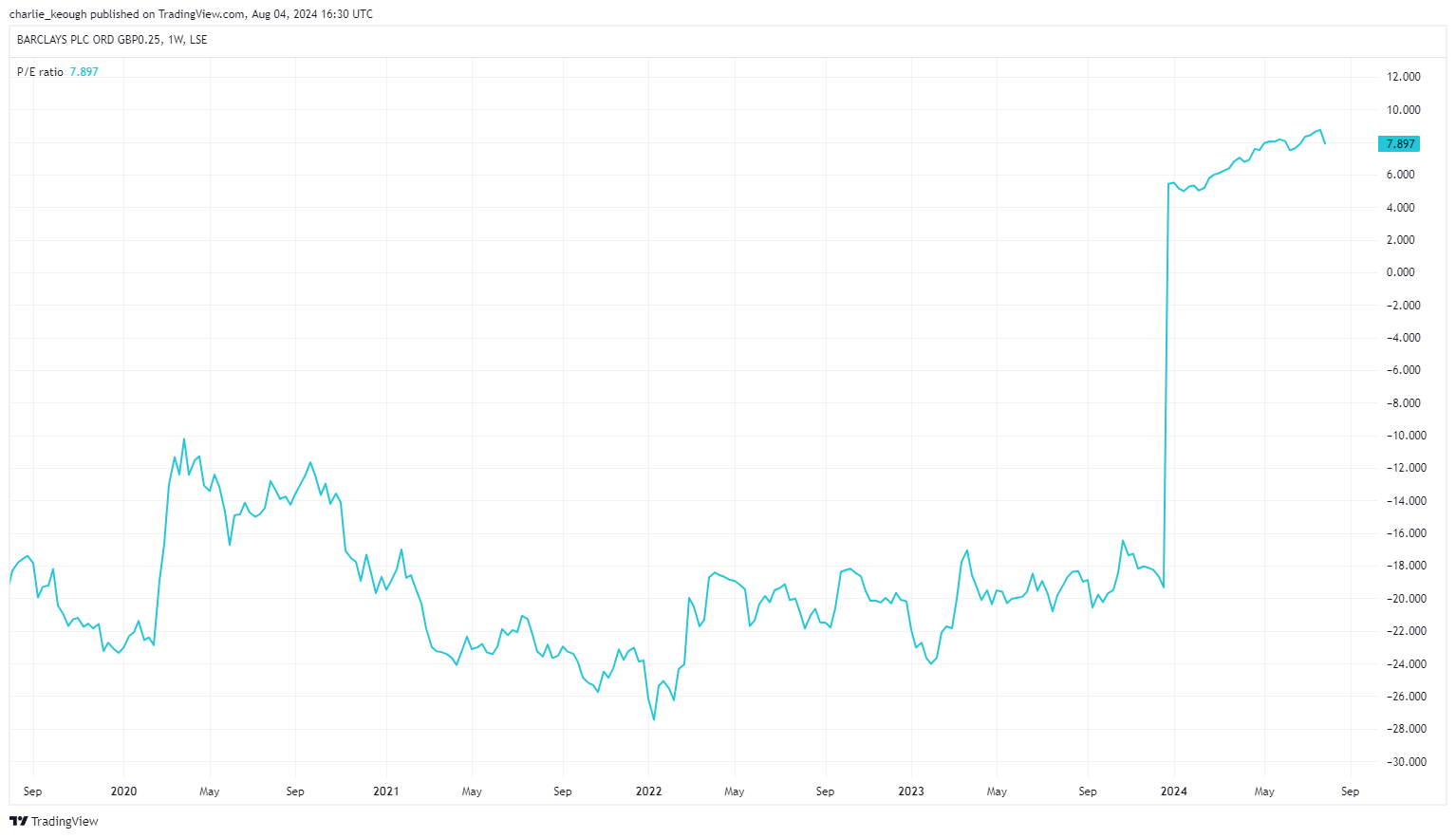

The bank trades on a trailing P/E of just 7.9, as seen below, and a forward P/E of 6.8. That’s way below the FTSE 100 average.

Created with TradingView

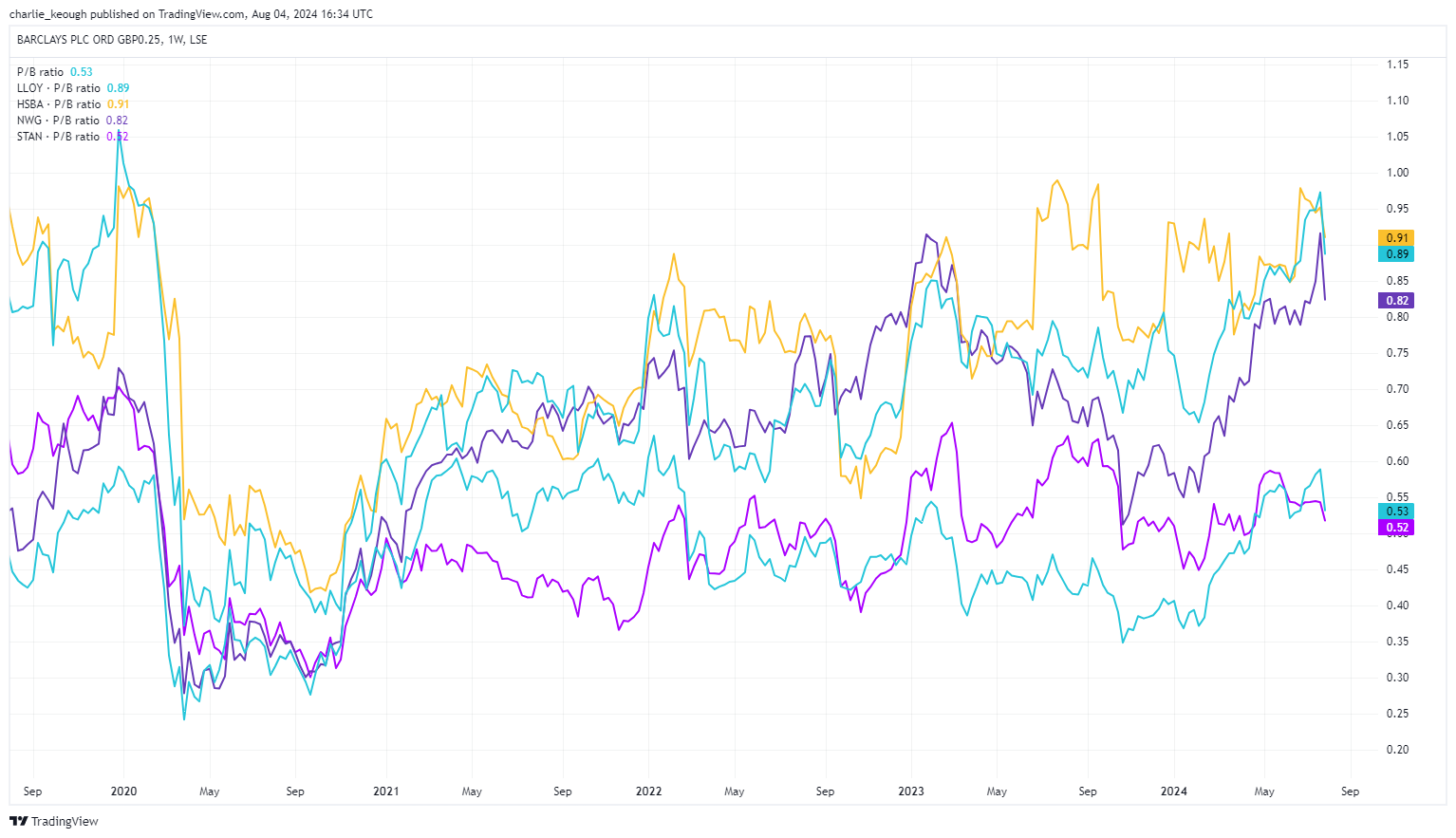

On top of that, the stock has a price-to-book ratio of just 0.5. The chart below shows how Barclays stacks up against other banks in the FTSE 100.

Created with TradingView

Future plans

I like the plans the firm has announced in the past couple of months for its future. Earlier this year, it revealed its first major strategic overhaul since 2016.

The business plans to streamline into five divisions to boost efficiency as well as cut costs. If all goes to plan, that should translate into higher profits.

Despite falling rates boosting investor confidence, they’ll pose a risk to Barclays as they’ll squeeze its margins. We’re still dealing with a lot of economic uncertainty, which provides a further threat.

But at its current price, I think Barclays is a prime example of an undervalued UK stock. I’d buy more if I had the cash.