It has been a solid 2024 for Lloyds (LSE: LLOY) shares. They’re up 11.9% year to date and 28.3% in the last six months. That easily beats the FTSE 100’s performance.

That includes a 7.1% rise in July. The stock’s performance has been underwhelming to say the least in recent years. Finally, to the joy of shareholders like myself, it seems to be gaining momentum.

But its impressive performance begs one question: is there still value left in the stock for investors? That’s what I’m here to try and answer.

Still cheap?

Let’s start by looking at the fundamentals: its valuation. For years the Lloyds share price was labelled as one of the best bargains on the Footsie by some investors. But with it on the up this year, can it still claim that label?

While its shares aren’t as cheap as they were, I reckon the stock still looks like good value. Right now, it trades on around 9.1 times trailing earnings. Looking forward, that figure drops to 8.2 for 2025 and just 6.9 for 2026.

For comparison, the FTSE 100 average is around 12. That shows there’s decent value in Lloyds at its price of 53.8p.

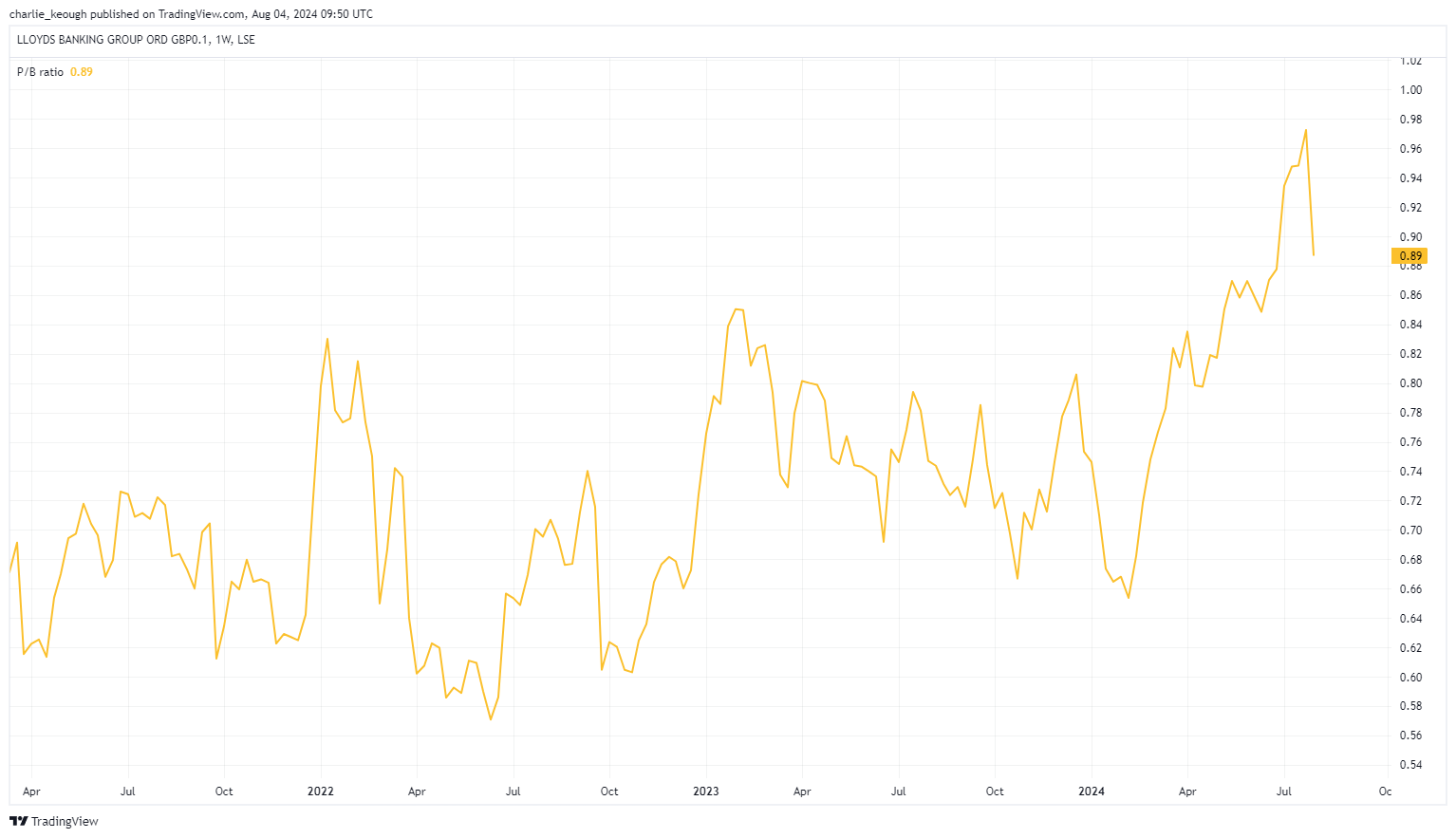

Another common valuation metric for banks is the price-to-book (P/B) ratio. This measures a company’s market valuation relative to its book value. A P/B of 1 is often considered fair value. As the chart below shows, Lloyds P/B is 0.9. Again, that signals there may be value in the stock.

Created with TradingView

Strategic goals

Based on the above, I think Lloyds still looks like good value. But of course, there are other factors to consider. For example, is the business itself in good shape?

Again, I’d argue yes. In its latest update to investors, it signalled it was on track to meet its 2024 and 2026 strategic outcomes.

This includes its strategic transformation, which has seen it invest £3bn between 2022 and 2024.

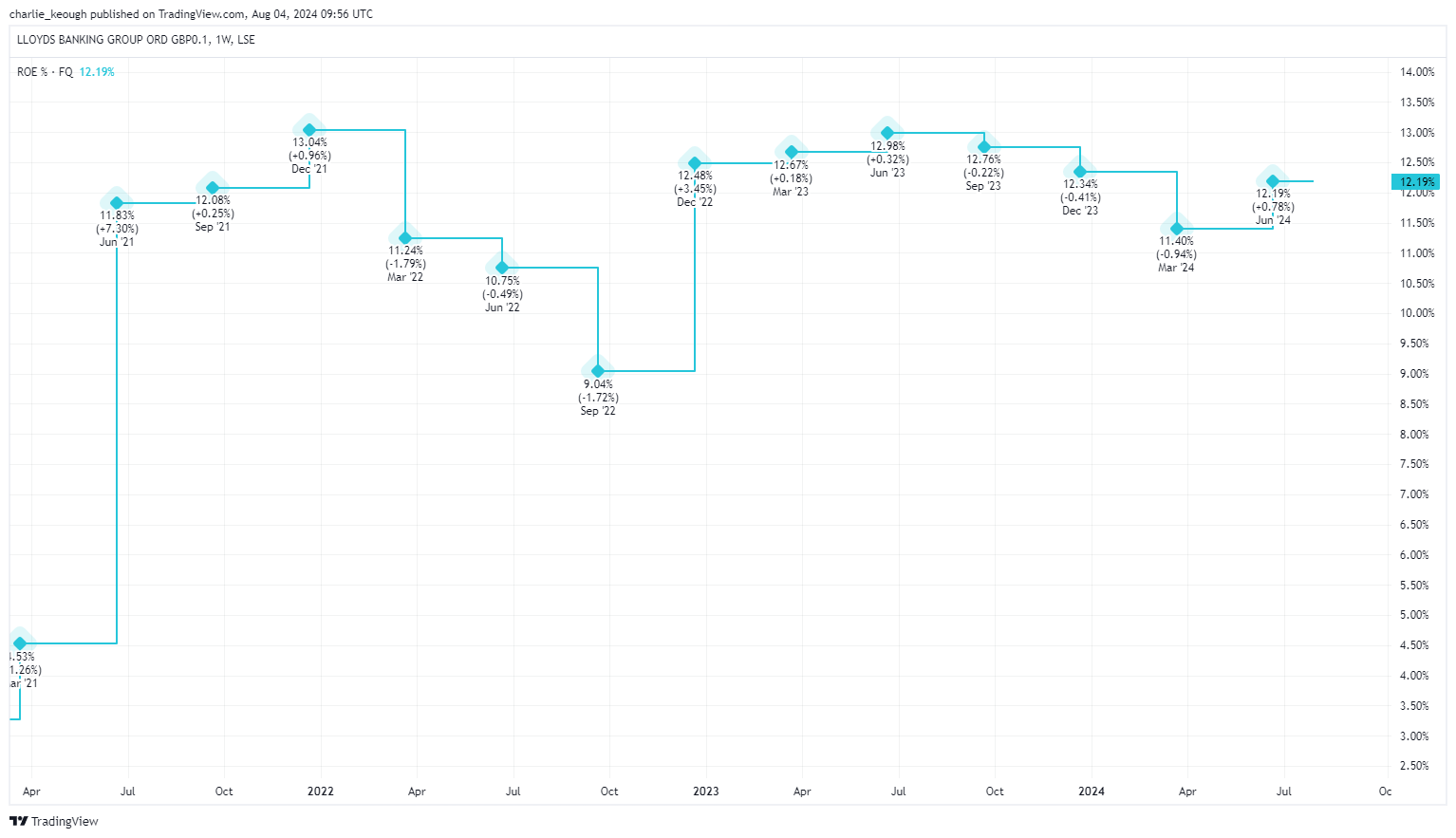

Looking to the years ahead, it has stated it remains confident in achieving its medium-term guidance for 2026. This includes targeting a return on equity greater than 15% by 2026. That would be a strong improvement on what it currently is, as shown below.

Created with TradingView

That said, there will be challenges in the years to come. The most pressing will be falling interest rates. The Bank of England cut the base rate on 1 August and in the months ahead we’re likely to see it fall further.

For banks, this means smaller margins, which will impact their bottom lines. Its net interest margin fell to 2.93% in the second quarter from 2.95% in the first.

More to come?

But I think the stock is one that investors should consider today. If I have some spare cash in the months ahead, I plan to add to my position.

Lloyds has risen 27.9% in the last year. Looking to the next 12 months, I don’t expect it to put up a similar performance given its quick rise.

But I think we can keep seeing it climb. In fact, analysts have slapped a 12-month target price of 62p on the stock. That represents a 15.3% premium from its current price.