FTSE 100 stocks are a popular asset class for individuals seeking a large and growing passive income. Even during tough and uncertain economic times, UK blue-chip shares have shown they have the mettle to increase dividends.

It’s a record that analysts from Computershare reckon will continue.

On the one hand, they think that the “sluggish global and UK economy” will limit dividend growth from British stocks in 2024. However, they still expect payout growth to remain “healthy,” and have predicted that “most sectors will show steady, low single-digit growth.”

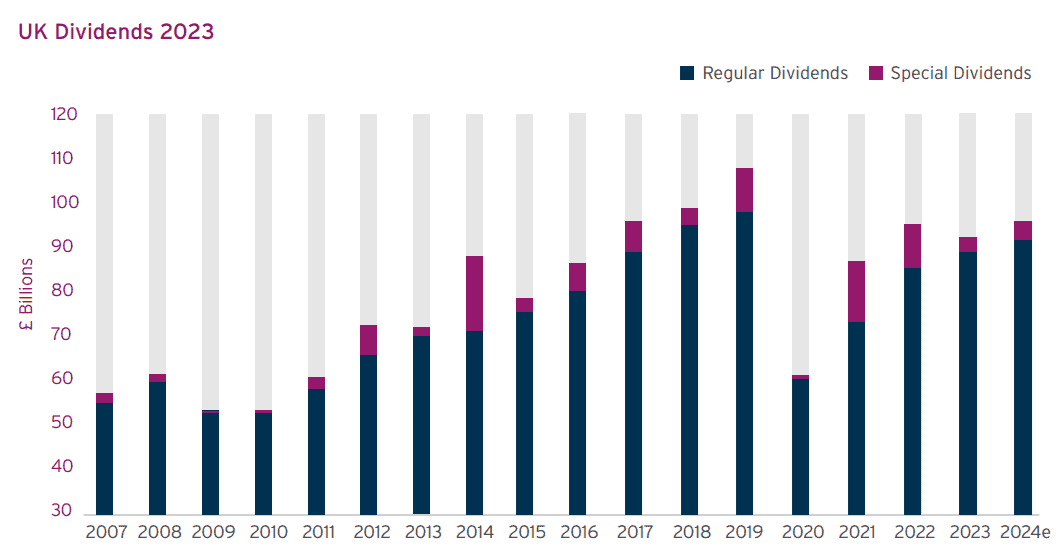

Special dividends are expected to keep coming thick and fast. And so Computershare thinks total payouts will hit £94.5bn in 2024, up 4.3% year on year.

A top income stock?

This means the average forward dividend yield for UK shares stands at a solid 4%.

But I think I can do better than this with some careful research. Banking giant HSBC Holdings (LSE:HSBA) is one FTSE 100 stock I think could deliver huge dividends this year and beyond.

The company faces near-term uncertainty as China’s economy struggles. Like other regional lenders, it’s particularly vulnerable to continued weakness in the country’s property sector.

But problems in Asia aren’t expected to impact HSBC’s ability to keep paying market-beating dividends. This is thanks in large part to the company’s rock-solid financial foundations.

Strong balance sheet

As of March, its CET1 capital ratio was 15.2%. This was up 0.4% from the same point in 2023, and gives the bank one of the industry’s strongest balance sheets.

HSBC’s immense financial clout meant it paid the largest dividend last year since the 2008 financial crisis. It also means the firm continues to make huge share repurchases.

The bank bought back $2bn of its stock in the first quarter. And in April it announced plans to acquire another $3bn worth.

Bright outlook

City analysts think the total dividend will rise to 83 US cents per share in 2024 from 61 cents last year. This includes a special payout following the recent sale of its Canadian operations, and it means that the yield on HSBC shares stands at an impressive 9.4%.

That’s more than double the current 4% average for UK shares.

But as a long-term investor, I’m not just interested in companies that will pay large ordinary dividends over the next couple of years.

I’m looking for those that have a good chance of delivering a growing and market-beating payout over an extended period. As Asia’s banking industry balloons, I believe that HSBC will have the tools to do just this.

A brilliant bargain

Researchers at Statista believe net interest income in the region’s bank sector will soar at a compound annual growth rate of 6.46% between now and 2028, to a whopping $9.12trn.

I don’t think this enormous opportunity is reflected by the cheapness of HSBC’s shares. Today they trade on a forward price-to-earnings (P/E) ratio of just 6.8 times.

Given the bank’s bright dividend outlook as well, I think this FTSE 100 share is one of the most attractive income stocks out there.