I’m a Games Workshop (LSE:GAW) shareholder and plan to invest more of my money in the business over time. One of the often overlooked elements of the company is its exceptional passive income prospects. Not only does the investment offer high growth, profitability, and good value, but it also has a dividend yield of 4.6%.

Here are the top reasons Games Workshop is my top pick for dividend income in Britain right now.

The quest for quality

The business is centred around fantasy boardgames, and it is undoubtedly the most financially successful in the industry, not only in Britain, but arguably internationally. It has hundreds of retail stores worldwide and was founded by three friends in the UK in 1975. It started as a small retail store in London.

Today, the company has a market cap of £3.13bn and has taken in £492m in revenue in the last 12 months. It has a balance sheet with only 30% of its assets attributed to different forms of debt, which is very strong.

Dividend history

The good news from the outset is that Games Workshop has not reduced its dividend since 2020. That was around the time of the pandemic.

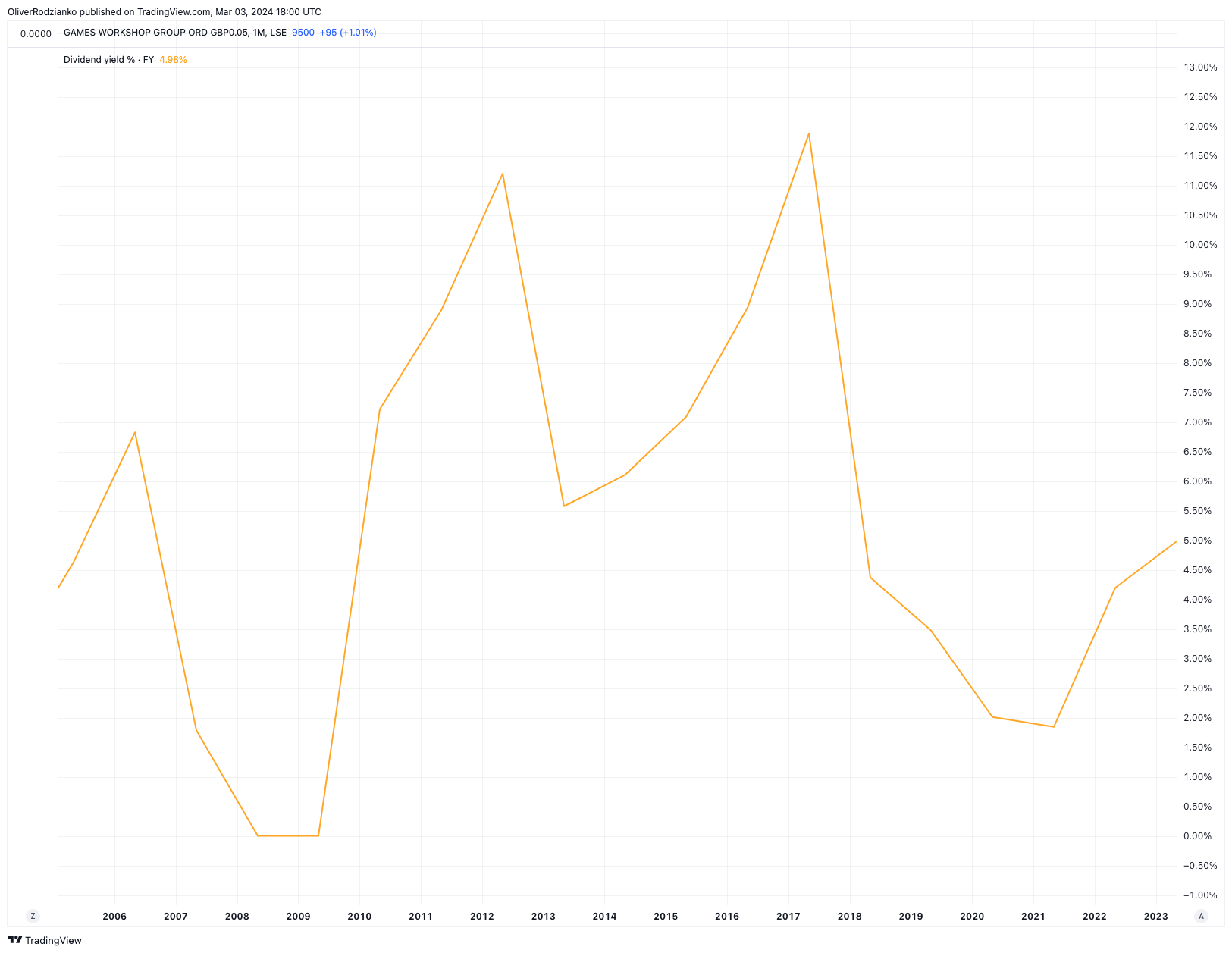

From the following graph, we can see that other than for a year following the 2008 financial crisis, the firm has paid a dividend every year for two decades. However, there is significant volatility in the dividend yield. It got as high as 11.9% in May 2017 and as low as 1.9% in 2022.

Source: TradingView

I consider it very rare for such a strong, growing, and profitable business to have such an appealing dividend yield. Often, with businesses as good as I consider Games Workshop, the dividends are next to nonexistent.

More than I bargained for

There’s also a really great metric called the yield on cost. This tells me how much the dividend yield is based on what I paid for my shares initially.

Imagine I paid £29 for a Games Workshop share in March 2019, and today, it’s yielding 4.6% of the present stock price of £95. That makes my yield on cost 14.4%. That’s because the dividends I am receiving are 14.4% of the price I initially paid.

These are all real-life figures and show how profitable dividends can be when they come from companies, like Games Workship, with high growth in the share price.

Two core risks

One of the key risks with Games Workshop’s dividends is that they aren’t immune to an economic crash, nor very recession-resistant. Therefore, I don’t want all of my income to come from this one company, even though I find that tempting.

Additionally, the business has dominated some of its core markets already. That means that over the long term, high growth might be unlikely. It could try to get more of an influence in Asia. However, the market is very different there, so it could be hard to have the same level of success.

One of my best

I consider this business undoubtedly one of the best investments I own. And I didn’t even buy it for the dividends!