I can’t believe I can buy a FTSE 100 blue-chip paying a brilliant dividend yield of 9.98%. Yet I can and I have.

I invested £2,000 in wealth manager M&G (LSE: MNG) in July, September and November last year. My £6k stake bought me 3,028 shares and the dividend income has already started rolling in.

I got my first payout of £133 in November and a second worth a thumping £405 in May, and reinvested both to buy another 261 shares. I can expect more of the same, with M&G shares forecast to yield 9.98% in 2024 and a staggering 10.3% in 2025.

FTSE 100 income hero

At this rate, I’ll double my money in just over seven years. If the M&G share price grows, I’ll get that on top. So what’s the catch?

The shares aren’t growing. They’ve barely shifted since M&G was hived off from Prudential in June 2019. They opened at 202.65p. Today, they’re at 204p. Over the last 12 months, they’ve climbed just 1.25%.

Personally, I believe things will pick up. When interest rates are finally cut, ultra-high-yielders like this one will look even more attractive relative to cash and bonds. Shares should recover across the board, driving up M&G’s net customer inflows and assets under management. That should lift the share price.

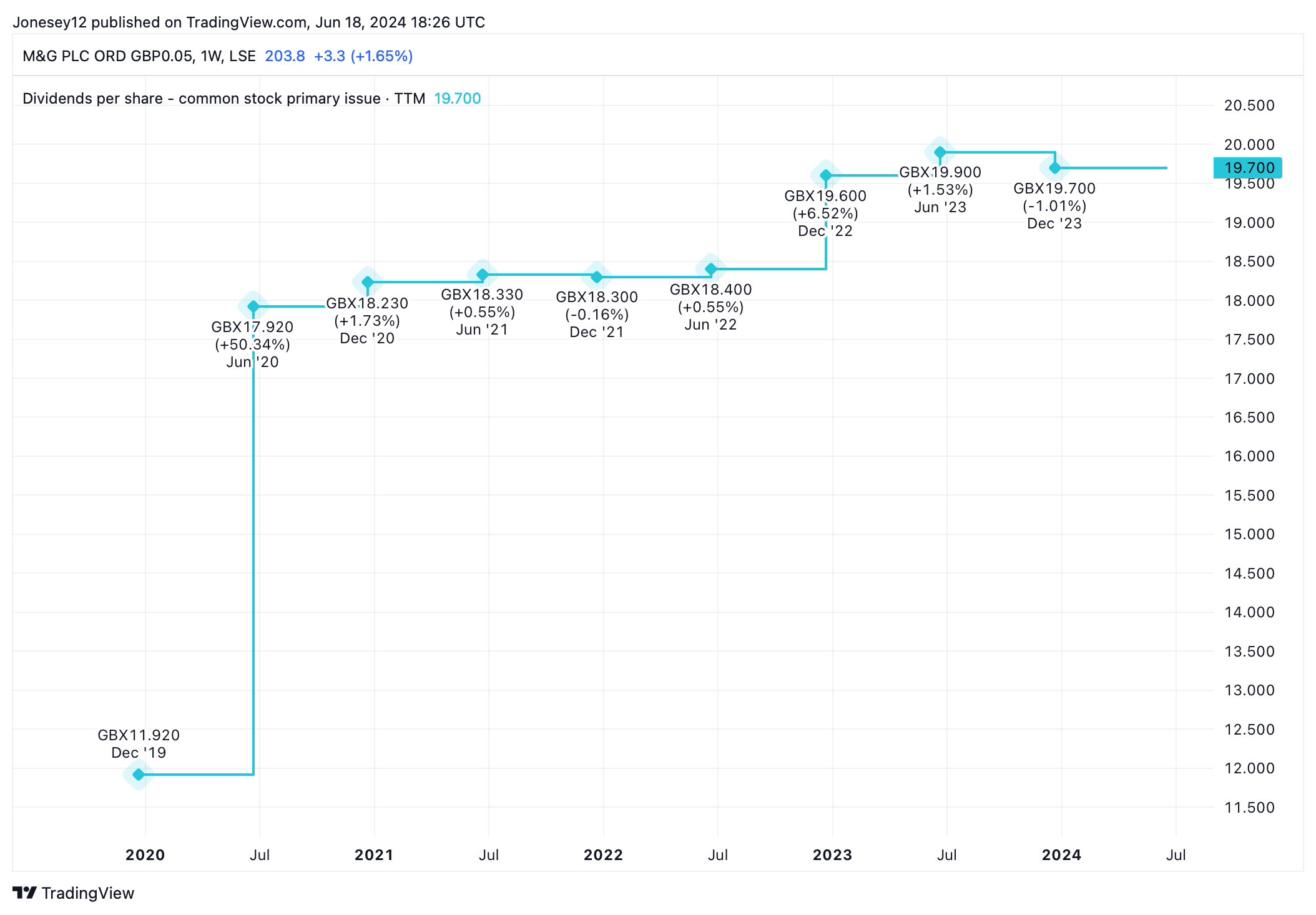

With rate cuts delayed again, the stock has fallen 13.23% in three months. I see this as a buying opportunity. The shares trade at a modest 9.35 times forward earnings. The big question is: will that dividend hold? Double-digit yields are notoriously unreliable. So what does M&G’s short, five-year track record suggest? Here’s what the chart says.

Chart by TradingView

The board has steadily increased dividends, just not by much. The last hike was a barely-there 0.1p to 19.7p per share.

I want to buy more

The share price fell as a result, even though the group had just posted a 28% increase in full-year 2023 profits. My guess is that management looked at that sky-high yield and thought, that’ll do for now. I don’t think we can expect better until the share price kicks on.

In many respects, that’s fine. It’s a pretty juicy yield. The board also affirmed its “policy of stable or increasing dividends”. Operating capital generation jumped 21% to £797m. Group CEO Andrea Rossi expects it to hit its three-year target of £2.5bn by the end of this year.

The group has also re-entered the booming bulk purchase annuity market and anticipates sales of £1bn to £1.5bn a year, opening up a fresh line of income.

That yield isn’t 100% secure, but it looks more solid than it should do. Given the recent share price drop, I’m tempted to top up my stake. I enjoyed getting a £400 cash injection in my portfolio in May. I fancy a bigger one next time. The dividends are generous, but I have to accept they won’t grow as fast as I’d like.