Precious metals continue to grab headlines in 2025 as jitteriness on financial markets heats up. Bullion-backed exchange-traded funds (ETFs) have exploded in value as gold prices have jumped.

Gold — which struck 40 separate record highs last year — is already up 11% in the five-and-a-bit weeks since New Year’s Day. It struck fresh new highs of $2,914 per ounce in recent hours.

I think there could be much further upside for gold prices too. And especially if bullion values move through the technically critical $3,000 marker.

A simple way for investors to capitalise on this scenario would be to buy a gold-tracking ETF. Inflows into European funds like this like this have rocketed of late — according to the World Gold Council, they hit their highest level since March 2022 last month.

I’m considering buying one such find for my own portfolio.

Top tracker

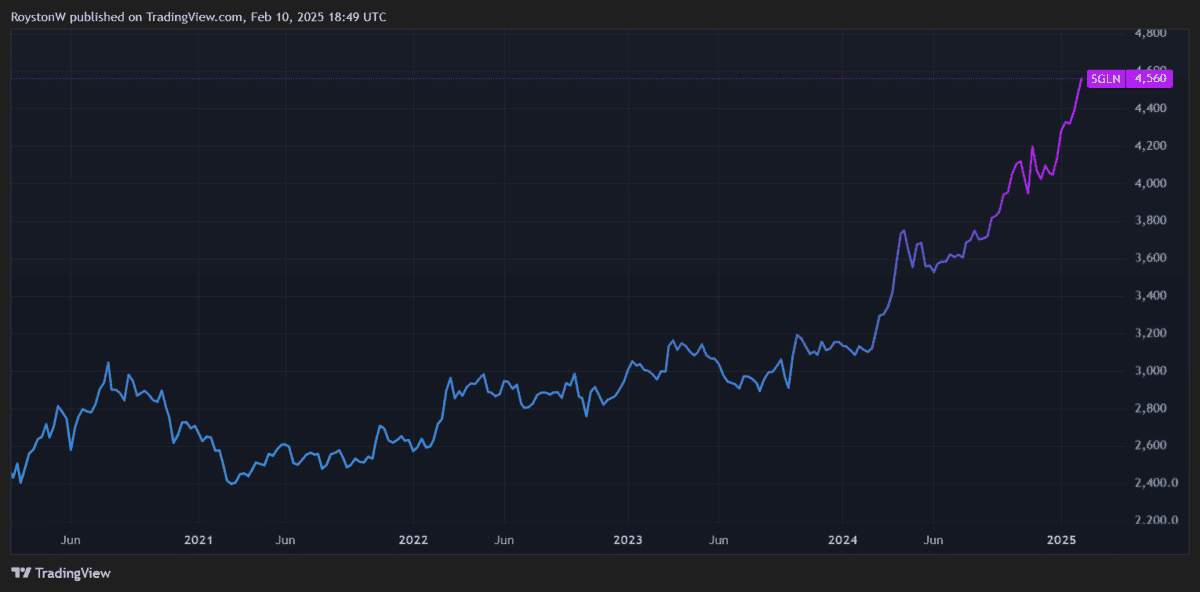

The iShares Physical Gold (LSE:SGLN) fund is one I think is worth a look because of its low charge structure. At 0.12%, its ongoing charge is one of the lowest in the business.

Funds like this allow investors to own gold without the hassle and cost of storage and delivery, nor worries of whether the metal they own is of acceptable quality. iShares says that 100% of the bars it holds meet criteria laid down by the London Bullion Market Association (LBMA).

This fund has another feature that makes it popular with certain investors. Unlike many ETFs, it tracks the metal price itself instead of a basket of companies with gold-mining operations. Therefore it protects individuals from the hazards attributed to minerals exploration, mine development and metal excavation.

Returns can be lower as a result. But it may be the preferred route to consider for risk-averse investors.

Another precious ETF

My view is that safe-haven demand for gold will continue to climb. There’s no guarantee of this, of course, and improving economic conditions that jolt market confidence could send it sharply lower.

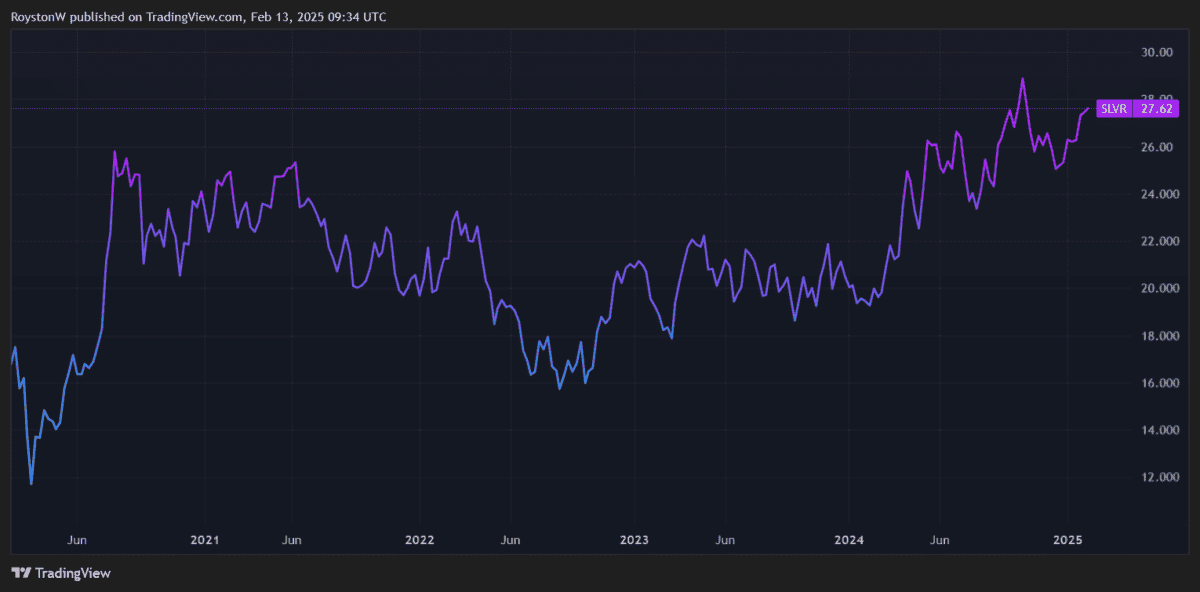

One way investors can ‘hedge their bets’ and mitigate the risks of this scenario is by considering a silver-backed ETF instead. One I feel that’s worth considering today is the WisdomTree Silver (LSE:SLVR) fund.

This financial instrument — which also tracks physical metal prices instead of mining stocks — has leapt in 2025 as worries over the global economy and geopolitical turbulence have grown, supercharging investment demand for silver.

While safe-haven buying could continue, silver prices may conversely rise if the global economy improves and industrial demand for the metal picks up. Sectors like the car industry and electronics segments account for around 55% of silver demand.

Despite its dual role as investment and industrial metal, there are risks to silver prices and by extension related funds. Like gold, values may fall if the US dollar strengthens, making it more expensive to buy the greenback-denominated asset.

On balance though, I think both these ETFs could continue taking off in 2025 and potentially beyond.