I’d love to have £12,000 to invest in a spread of passive income stocks. Sadly, I’ve invested every penny I’ve got. But if I did have £12k to hand, I’d invest it across three UK dividend growth companies, inside a Stocks and Shares ISA.

I’d start by investing £4,000 into utility giant National Grid (LSE: NG). This is one of the most popular income stocks on the index, and for good reason.

I’m chasing FTSE 100 dividends

National Grid owns and operates the electric and gas transmission system in England and Wales. Basically, it’s a regulated monopoly, which makes its revenues a lot more reliable than a company that has to beat off competitors.

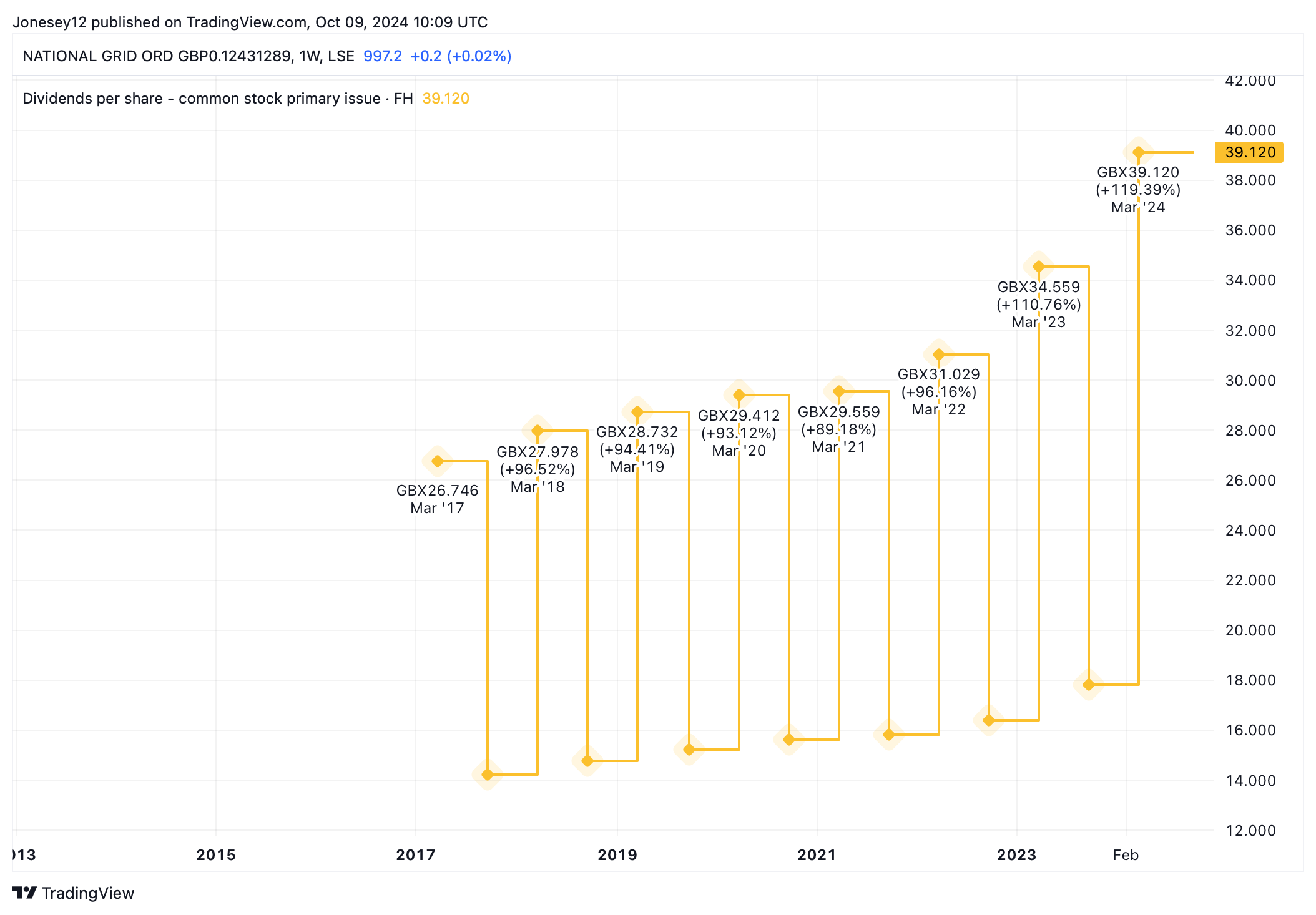

It also has a solid track record of increasing its dividend, year after year. Let’s see what the chart says.

Chart by TradingView

In 2024, National Grid increased its total dividends by 5.55% to 58.52p per share, which gives investors a trailing yield of 5.9%.

Dividend cover’s relatively thin at 1.4, but National Grid can get away with that, because of the reliable nature of its earnings.

The National Grid share price is up 15.48% over the last 12 months. That’s despite falling more than 10% on 23 May, when the board announced a £7bn rights issue to fund much-needed energy infrastructure investment.

The shares came storming back after that setback, showing the wealth of investor demand for this stock. National Grid shares look good value, trading at 11.8 times earnings, and I’d love to hold them in my portfolio.

Earning money without any effort

Next, I’d also invest £4k in oil giant BP, which looks a bargain trading at just 6.06 times earnings while yielding 5.52%. I’d invest the final £4k of my £12k in insurer Phoenix Group Holdings. It yields a staggering 10.08% a year, but is a little pricier, trading at 15.92 times earnings.

By creating a balanced portfolio of between 15 and 20 stocks like these over time, I’d hope to generate an average annual total return of 9% a year, with dividends reinvested.

There are no guarantees when investing in shares, but if I did manage that, I’d turn my £12,000 into £159,212 after 30 years.

Combined, National Grid, BP and Phoenix offer an average yield of 7.17%. If I managed that yield across my portfolio, that £159,212 sum would give me income of £11,415 a year. That’s almost as much as I invested in the first place. Incredible!

With luck, my passive income will rise every year, as companies look to increase shareholder payouts. Again, no guarantees and it could fall too.

I wouldn’t stop with just £12,000. Instead, I’d continue to pump money into my ISA whenever I had cash to spare, targeting attractively-valued high-yield FTSE 100 shares. That way, I’d hope my second income could rise way beyond £11,415 a year.