Even with interest rates at their highest level since 2008, I don’t think holding cash is a good long-term idea. I’d rather invest in dividend shares.

I’m expecting interest rates to fall sooner or later and share prices to move higher when they do. But by locking in some attractive dividend yields at today’s prices, I’m hoping to be prepared for when returns on cash fall.

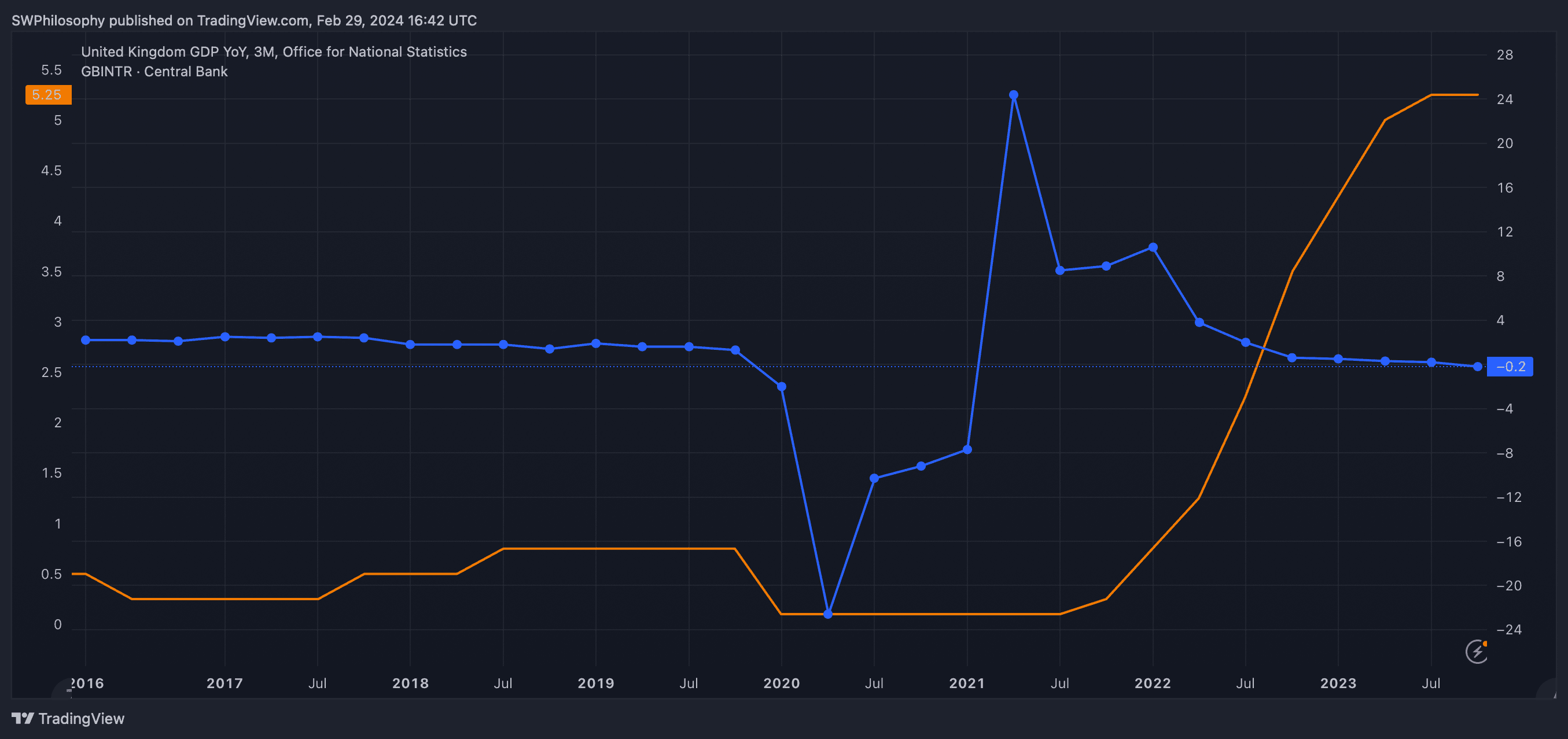

Interest rates

The Bank of England has set out plans to keep interest rates high until inflation reaches its target levels. I can see the merit in that policy, but it has come at a significant cost in terms of GDP growth.

Created at TradingView

Since the central bank began raising interest rates, the rate of GDP growth has come down to the point that it’s now turned negative. And I think that cutting rates to address this is going to happen sooner or later.

When it does, I expect the rate that savers can get on their cash to fall significantly. And that will make today’s dividend yields look attractive by comparison, causing share prices to rise.

To avoid being stuck in a situation where weak returns on cash are met with high share prices, I’m looking for stocks to buy today. And there are a couple of dividend shares that I think look especially promising.

Diageo

A 2.75% dividend yield might not look like much, but Diageo (LSE:DGE) shares should be on the radar of dividend investors looking for stocks to buy. The underlying business is a strong one with a bright future.

The strength of the company’s brands is evident in its operating margins. Over the last 10 years, these have been consistently higher than Pepsi or even the mighty Coca-Cola.

Created at TradingView

Profits have declined recently, especially in Latin America and the Caribbean. And there’s a risk this could continue for some time in a difficult macroeconomic environment.

Ultimately though, I think the trend towards more premium beverages – which suits Diageo – is a durable one. So I’d use right now as an opportunity to invest in the stock at a decent price.

Pfizer

The last time Pfizer (NYSE:PFE) shares came with a dividend yield this high, the stock market was dealing with the crisis of 2008-09. That gives some indication of the current situation.

Created at TradingView

Demand for Covid-19 vaccines has fallen from extreme highs to extreme lows. And there’s always a risk that new drugs and vaccines might be difficult to develop.

Analysts are expecting earnings between $2.05 and $2.35 for this year though, rising steadily over the next few years. And at that level, the $1.68 per share dividend is comfortably covered.

It’s worth noting that Pfizer actually increased its dividend going into 2024. Despite the uncertainty, I see this as a great opportunity to buy shares for a significant passive income boost.

Investing £10,000

With interest rates set to rise, I’m looking to get my excess cash into shares where I can see opportunities. And I think both Diageo and Pfizer can offer good returns for the next decade and beyond.

Both look like strong businesses that operate in diverse industries and countries. Investing £5,000 in each looks to me like a great use of £10,000 in excess savings.